At 10am on July 13 th, the bank of Canada raised its benchmark interest rate by the largest amount in 20 years in an effort to combat runaway inflation. Economists had been expecting an increase of 0.75%, but the 1% increase came as a shock to most. You can read the announcement below:

Bank of Canada governor Tiff Macklem said the bank made the decision to front-load its rate-hiking campaign because Canadians “are getting more worried that high inflation is here to stay. We cannot let that happen.“

“We are increasing our policy interest rate quickly to prevent high inflation from becoming entrenched. If it does, it will be more painful for the economy — and for Canadians — to get inflation back down,” he said, noting that the bank doesn’t expect the official inflation rate to come down to three per cent until next year, and wont get back to its two per cent target until 2024.

How Does This Rate Increase Affect Me?

What Should You Do?

This answer will be totally unique to you.

The Bank of Canada has indicated that more interest rate increases are on the horizon. If you choose to lock your variable rate mortgage into a fixed rate mortgage, you are voluntarily taking the higher payment straight away, which is what you’re trying to avoid. If, however, knowing your payment will not adjust any further helps you sleep at night, then maybe it is time to consider locking in.

Statistics indicate approximately 60% of Canadians will “break” their mortgage midterm, and when they do this, a penalty is incured. This penalty is typically significantly higher for a fixed rate mortgage than for a variable rate mortgage, because the penalty is the interest rate differential. Think long term.

What Isn’t the Bank of Canada Saying?

They did not mention the word recession in their announcement. There is now more talk of the inevitability of a recession happening as soon as next year. Should this happen, then we would expect to see the benchmark rate decrease, and mortgage rates go down again. The BoC raises rates to cool an overheated economy and cuts rates to stimulate it again and encourage people to invest.

A Couple Of Options To Consider

As mentioned above, locking into a fixed is one option which may give you peace of mine, but it could be the wrong financial decision in the long run. Another option could be re-amortizing your mortgage. Say you have 20 years left on your mortgage: You could increase the amortizing back up to 30 years, meaning you pay the mortgage off over a longer period, but decrease your monthly payment. Once things stabilize in the future, you can then use your prepayment privileges to overpay each month, and effectively reduce your amortization again.

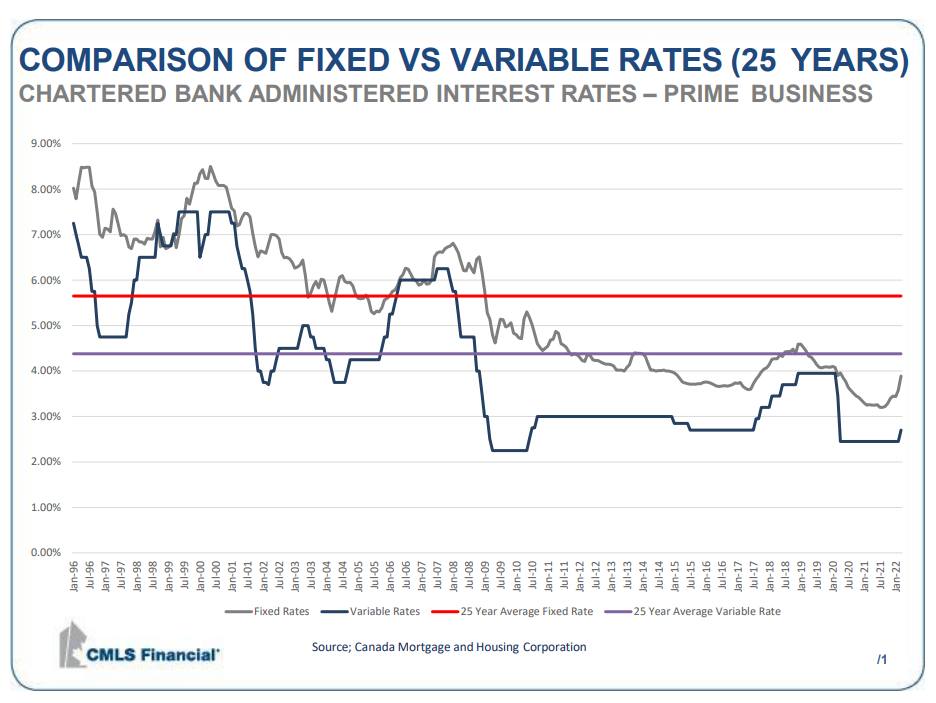

The Lessons History Provides

- The variable rate here DOES NOT show the discount from the bank lenders. Variable is always Prime minus X. Prime is what you see on the chart. The discount can be Prime minus 1, Prime minus 0.95, Prime minus 0.5, etc. So the variable rate is actually lower than what you see on the chart.

- Pick any 5 year time frame you see on the chart and calculate if it was better to be in a 5 year fixed or a 5 year variable, and calculate the net rate for the term.

Example 1:

In July of 1999, variable peaked at ~7.50%. At the same time, Fixed was identical. If you took a 5 year fixed at that time, you were paying 7.50% until 2004. Meanwhile, the variable went down, up and back down to as low as ~3.85%. And this does not include the discount, where the rate could have actually been 2.85% (depending on the bank lender). The savings on interest would have been significant.

Example 2:

In July 2005, Variable was ~4.20% while Fixed was at ~6.00%. Over the 5 year term, variable went up, looking like it surpassed the original fixed rate one could have taken. But remember, the ‘discount to prime’. This could have kept the variable rate at 5%. Over the five year term, it dropped down to 2.20%

(plus the discount). Again, significant savings on interest paid.

Some things to consider:

- Variable goes up and variable goes down

- Don’t panic and lock in when the variable goes up

- You must think long term and not short term

- Always discuss your mortgage with a mortgage professional and not the media or your friends and

family (unless they are licensed mortgage professional)

Want to learn more?

I would be happy to discuss what this rate increase means for your mortgage and discuss in further detail what options are available to you if choose to make a change.

Tim Ward, Collingwood Mortgage Broker.